This blog is to report that Mr. Sachchida Nand Patel, CTO Lucknow Sector-19 has sent a notice to a company for discrepancy in GST return filing which was done in the year 2020-21 which is almost 4 years old. Attached notice.

The company tried to gather data which was 4 years old from both the suppliers and vendors. But as this data was 4 years old. None of the suppliers/vendors had stored all the necessary records to re-verify the sales and purchase invoices. So they asked for more time from the GST department.

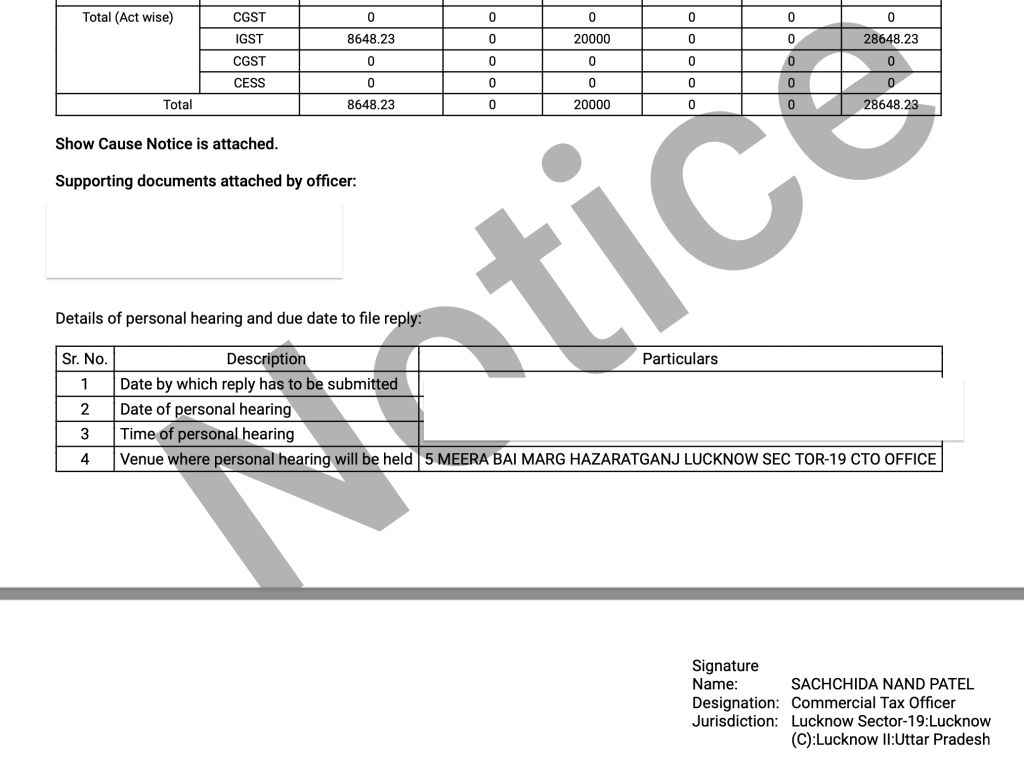

In response, Mr. Sachchida Nand Patel, charges a sum of Rs 28648 which is more than the turnover (total sales and purchase) done by the company in that financial year.

This demand and request is not legitimate, because how can anyone pay for a tax amount which was already paid. And they pay it a second time again such that it exceeds not only the sales but also purchases ?

Your request/demand for anything is only legitimate when you think about the loss of another person from your demand. And this blog wants to highlight the greed, ignorance and lack of empathy of the UTTAR PRADESH GST department towards honest tax payers.

Leave a Reply